Get Ready for the 2019 Tax Season

Filing your taxes can feel overwhelming and paperwork isn’t exactly fun. Fortunately, one of the benefits of being a Lyft driver is filing your taxes as a self-employed person. That means you can claim your expenses related to Lyft driving as business deductions. We’re here to support you through tax season, helping you prepare and receive expert tax advice through our partnership with TurboTax.

Tax Summary Document

If you drove with Lyft in 2018, look out for your personalized Tax Summary document, available by January 31. This document will include the key info you need to file taxes for your Lyft earnings. It will include your:

gross earnings (Here’s how this is calculated this year.)

total online miles

Lyft expenses (including Express Drive rental if relevant)

non-ride earnings from referrals/bonuses, etc.

The second page will contain guidance from TurboTax including possible deductions like:

mileage

operating expenses

vehicle expenses

We’ll send you an email when your Tax Summary document is available in the Tax Information tab of your Driver Dashboard.

1099 Forms

During previous years, we’ve sent 1099 forms to all drivers who earned $600 or more driving with Lyft. This year, we’re only sending 1099-K forms to drivers who have earned $20,000 or more with Lyft in ride-related earnings.

Lyft will send 1099-MISC forms to drivers who earned at least $600 through non-driving activities like referrals and other bonuses in 2018.

If you’re eligible for a 1099-K or 1099-MISC form, they can be downloaded from the Tax Information tab of your Driver Dashboard.

You’ll likely still have to file your taxes even if you don’t receive a 1099. If you’ve earned less than $20K with Lyft in 2018, you’ll have all the info you need in the Tax Summary document.

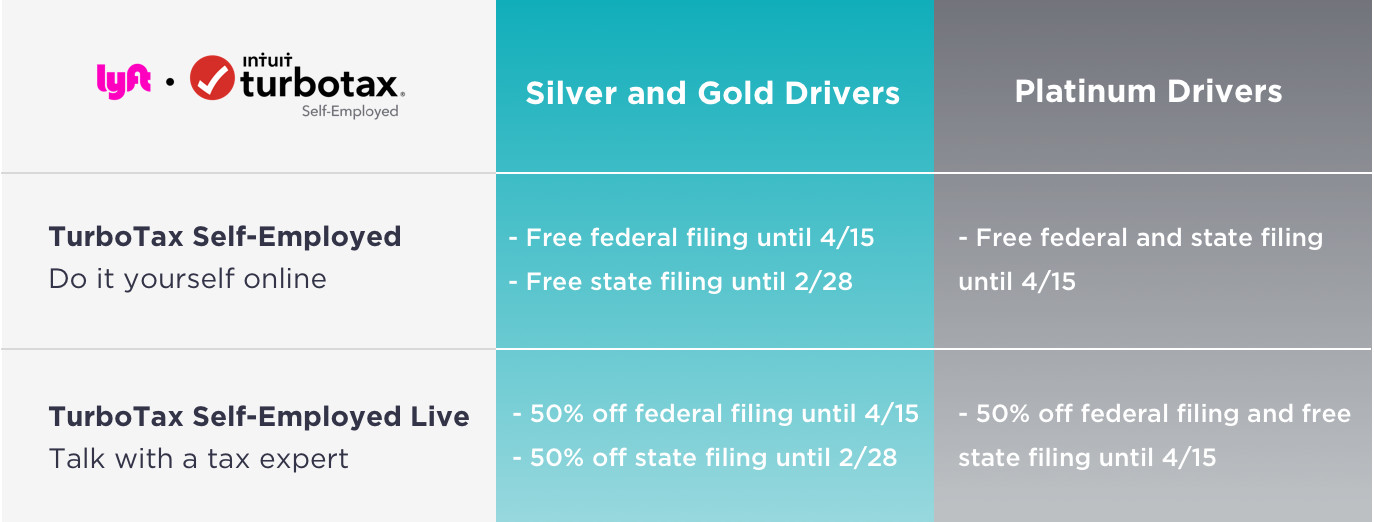

Special TurboTax Offers for Accelerate Drivers

We’re partnering with TurboTax — for the fifth year in a row — offering all Accelerate drivers free access to TurboTax Self-Employed, and 50% off TurboTax Self-Employed Live (which includes the ability to chat with a tax expert from the comfort of your home).

Start taking advantage of your offers now with free filing, discounted tax advice, and tips on what you can deduct.

Not currently an Accelerate driver? Qualify for Silver and become eligible just by giving 10 rides in three months.

Tax Season at a Glance

Get prepared: Make sure your tax information is up-to-date in your Driver Dashboard. Start checking out your TurboTax offers and decide what’s right for you.

See your Tax Summary document: Access your earnings info, mileage, and tax forms (if applicable) in the Tax Information tab of your Driver Dashboard.

File Annual Taxes: Get it done for less with TurboTax Self-Employed or TurboTax Self-Employed Live. TurboTax can help you get all the deductions you’re eligible for.

Get Answers at Live and Virtual Tax Events

We’re here to help make filing your taxes as painless as possible. Stay tuned for tax events at your local Hub, as well as TurboTax-hosted webinars, and more.